In recent years, fluctuations in the international financial market have been increasingly intense. Influenced by factors such as geopolitical conflicts, adjustments in monetary policies, and changes in economic cycles, global capital flows have become more frequent and difficult to predict. In such an environment, financial institutions have put forward higher requirements for the stability, security, and real-time nature of cross-border communication. Whether it is foreign exchange transactions, securities settlement, customer identity verification, or risk early warning notifications, any communication delay or interruption may lead to transaction failures, capital losses, and even legal disputes.

The IntBell virtual number, with its stable technical architecture, global network coverage, and highly secure communication solutions, has become a key tool for many financial institutions to deal with market fluctuations. This article will explore the communication challenges in the international financial market, analyze how IntBell ensures the communication stability of financial institutions, demonstrate its practical value through real cases, and finally call on practitioners in the financial industry to actively adopt suitable solutions to enhance business resilience.

Since 2023, the global financial market has experienced severe turbulence:

Against this backdrop, financial institutions need more efficient cross-border transaction execution capabilities, and all of this depends on a stable and low-latency communication system.

Traditional communication methods (such as ordinary SIM cards and PSTN landlines) have many problems in cross-border scenarios:

✔ High Latency: The complex international routing leads to delays in calls and text messages;

✔ Unstable: The poor network coverage of operators in some regions affects the connection quality;

✔ Insufficient Security: Unencrypted communication may be intercepted, resulting in data leakage.

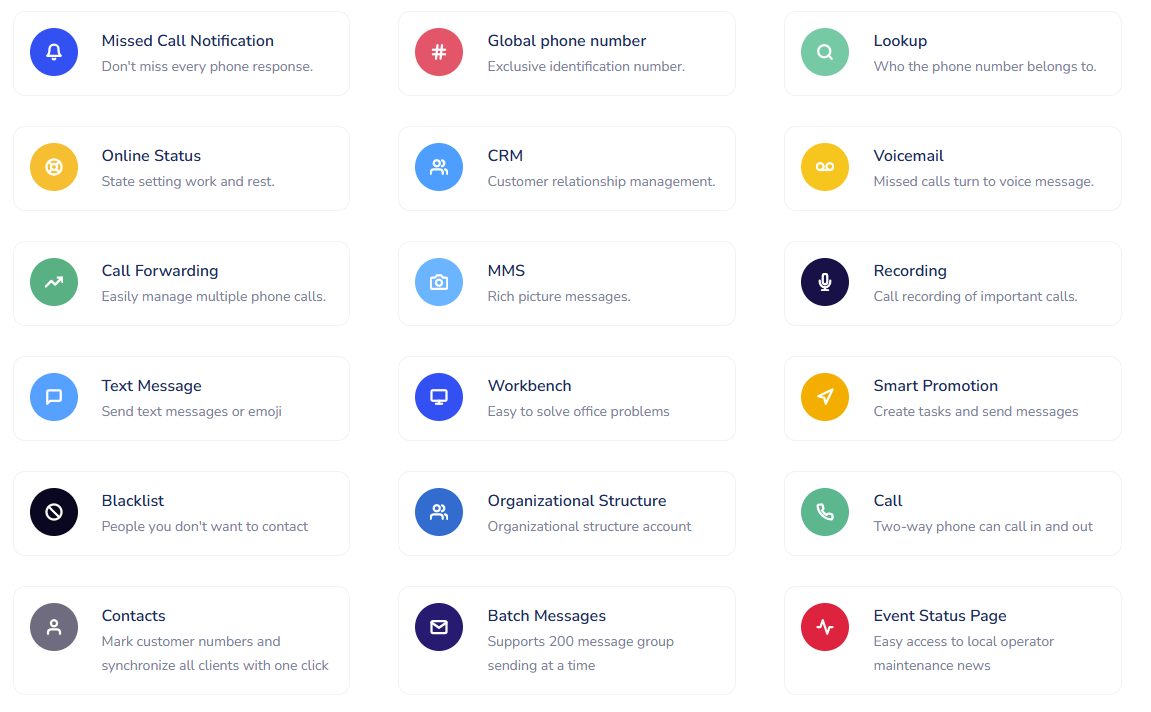

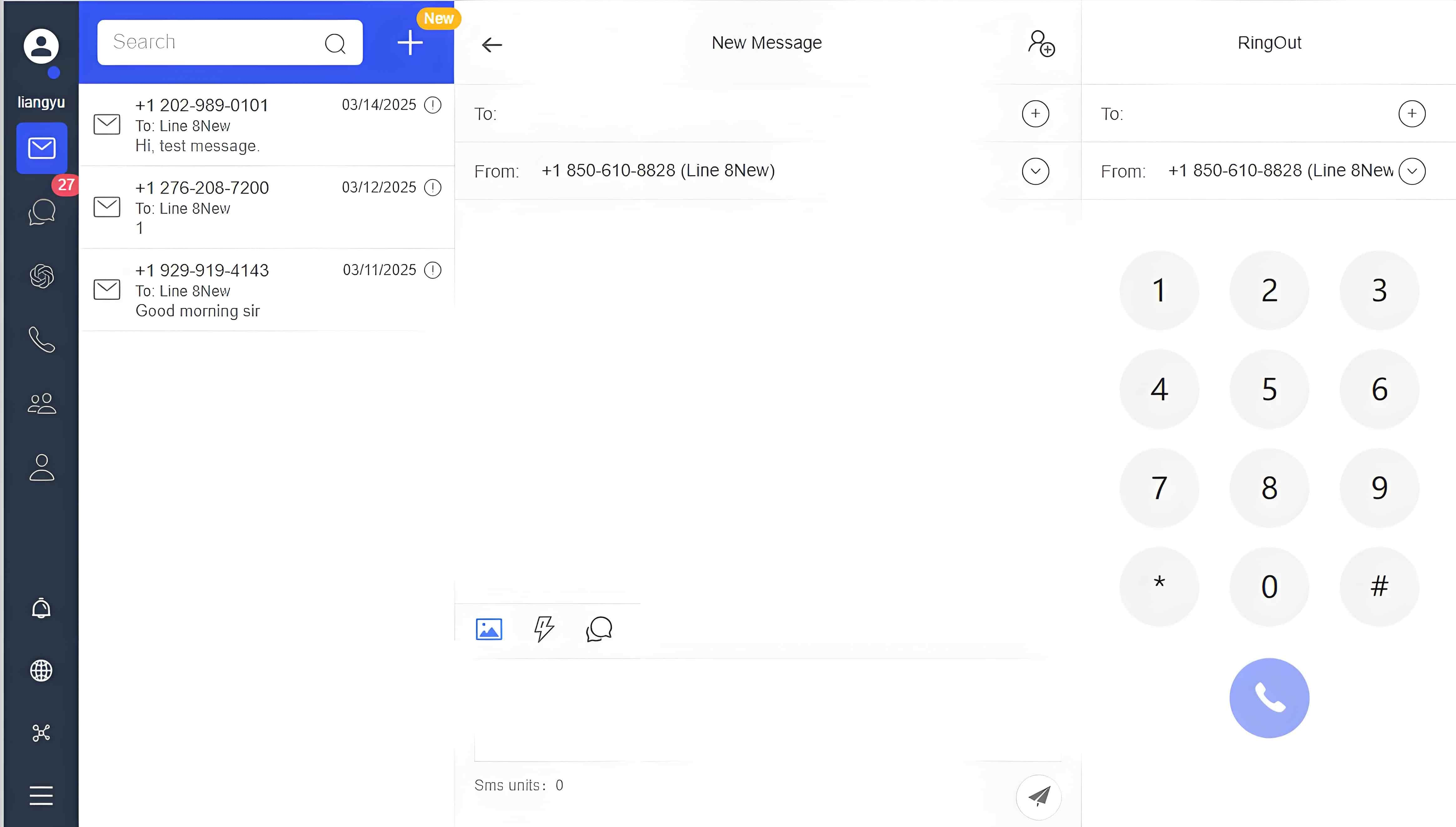

IntBell provides local virtual numbers that cover major financial markets in Europe, America, Asia-Pacific, the Middle East, etc. Financial institutions can achieve the following through IntBell numbers:

In a market environment with intensified fluctuations, the competitiveness of financial institutions depends not only on investment strategies but also on the stability of the underlying infrastructure. IntBell virtual numbers empower the financial industry in the following ways:

✅ Improve Transaction Execution Efficiency: Reduce communication delays and seize the ever-changing market opportunities;

✅ Enhance Customer Trust: Ensure that key notifications (such as account changes and risk control reminders) are delivered in a timely manner;

✅ Reduce Compliance Risks: Meet the requirements of regulatory authorities for the traceability and security of communication.

The uncertainty of the international financial market will continue, and financial institutions must plan ahead and optimize their communication infrastructure. The IntBell virtual number, with its global coverage, highly available architecture, and financial-grade security standards, has become the preferred solution for many banks, securities firms, and payment companies.

In a volatile market, stable communication is the core of competitiveness. Choose IntBell to make your financial business fearless of risks and move forward steadily.